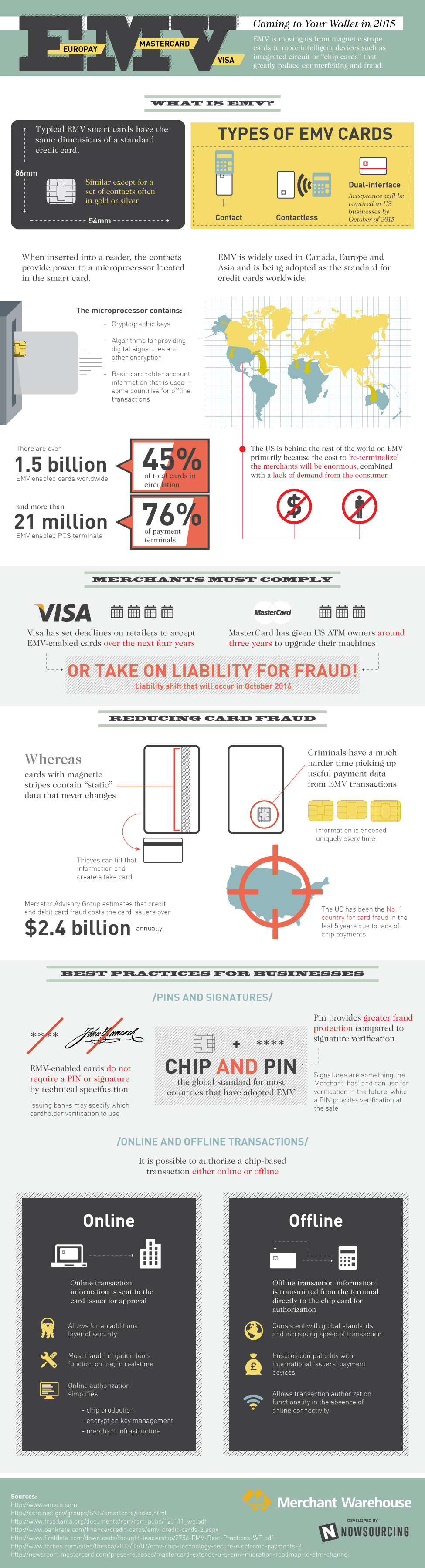

EMV is switching cards from the magnetic stripe to an integrated circuit card. This type of card – the “chip” card – is usually the same size as a standard credit card and can either be a contact or no-contact version. A microprocessor within the card provides power; it also contains cryptographic keys, algorithms for providing digital signatures and other encryptions, and basic cardholder account information.

Already EMV is widely used in Canada, Asia, and Europe but the US is lagging behind. EMV-enabled cards account for 45% of total cards in circulation globally and 76% of payment terminals are EMV-enabled. The US falls behind due to the high cost of switching merchants over to the new system. Visa has told retailers that within the next four years they must accept EMV and Mastercard has told ATM owners they must upgrade their machines or be liable for fraud.

EMV-enabled cards help reduce credit card fraud. The US has been the number one country for credit card fraud in the past five years due to lack of chip payments. Magnetic strip cards contain static information that never changes whereas EMV chips allow information to be encoded uniquely every time.

Check out this infographic presented by Merchant Warehouse to learn more about EMV and its benefits.

Brought to you by Merchant Warehouse

Brought to you by Merchant Warehouse

Leave a Reply