The numbers are completely off the charts. In case you missed insane valuations in recent months for companies such as Facebook, Twitter, and LinkedIn, the infographic below should bring it into perspective.

When did value start getting dictated by users rather than revenue? Something can definitely be said about potential, but are investors really doing the right thing by betting so high on some of these companies. As a general rule, a company is normally worth somewhere between 3-6 times its yearly revenue. That would put Facebook with an estimate 2010 revenue around $2 billion valued at somewhere in the $6 billion to $12 billion range. Double that for the world of potential that the site and its ever-growing userbase creates and you have a realistic value capped around $25 billion on a good day.

It is possible that Facebook is currently valued just shy of $100 billion. In any business reality, this is insane.

Many will point to the fact that having such influence over the day-to-day lives of the masses gives it intrinsic value that goes beyond the revenue. While this is a valid argument, one should also consider the fickle nature of the internet, the people using it, and the exponential expansion of technological knowledge that demonstrates one thing: there is no such thing as “too big to fail” on the internet. Ask AOL, MySpace, Yahoo, and many other companies that were once juggernauts but that are now clinging to their financial models with everything they have simply to stay relevant.

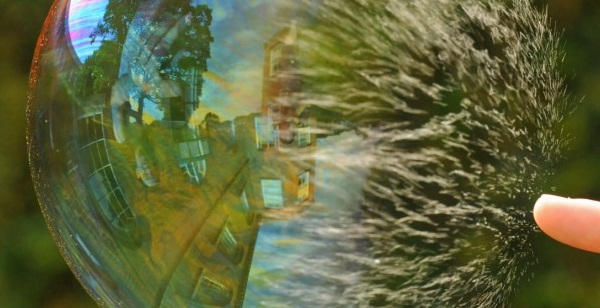

This graphic by our friends at G+ takes a look at it from an empirical perspective. The numbers are there. This is an online tech bubble. It will burst sometime in the near future.

That is so interesting! Better get my company off the ground asap then….

wouldnt you have loved to own facebook right now lol

also color is one of the most pointless things ive ever seen